COIN is an investment advisory platform that helps you invest in a custom mix of companies making an impact in the areas you care about most, or Impact Areas, that scores companies not on historic performance but based on their ranking in those Impact Areas. Companies doing more to combat climate change, for example, rank highly and are put into a portfolio that selects an Impact Area of “Climate Action”.

Snapshot

COIN

So this one is an interesting concept with a few site-related problems.

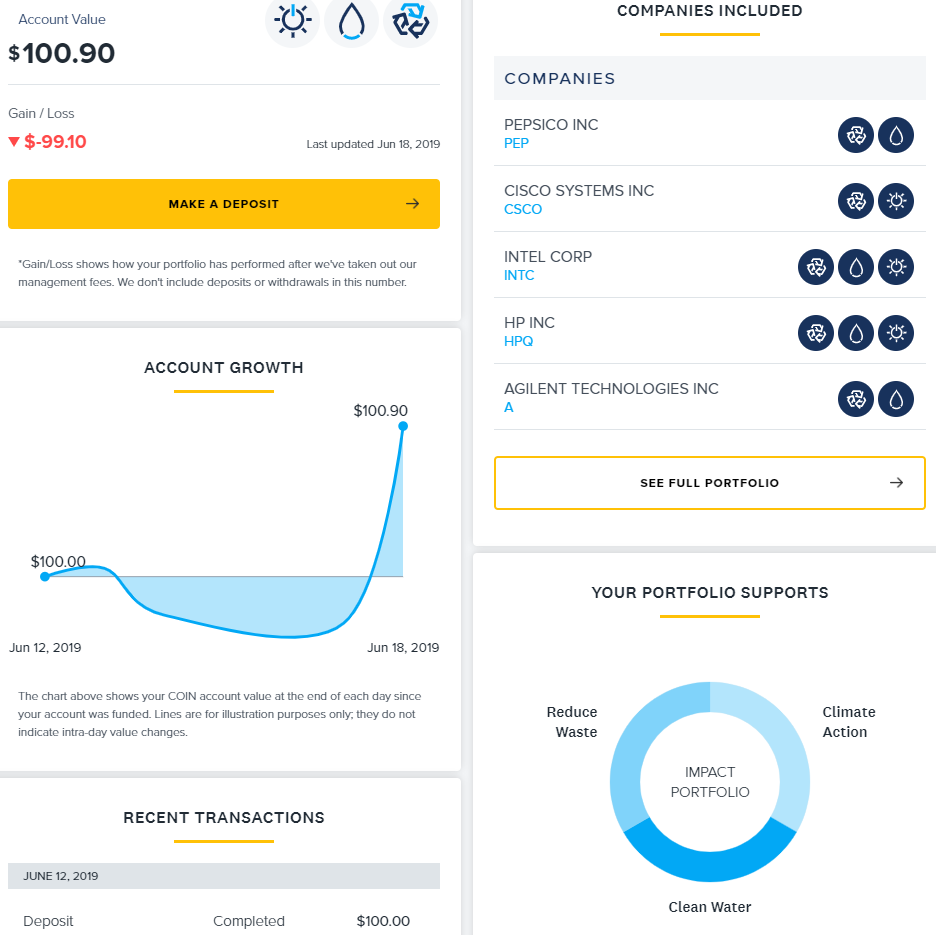

Firstly, the COIN website does not tell you up front what companies will be in your portfolio. You choose three Impact Areas when you create your portfolio (and can change them at any time) out of a current eight total. You can choose from Climate Action, Better Health, Gender Equality, Clean Water, Quality Work, Reduce Waste, Modern Cities, and Shared Prosperity. Choose three, invest your money.

Second, once you have a portfolio consisting of said companies, they do not tell you your shares, or the value of those shares on the website (with one exception, listed below). Better Health not working out for you? You’ll never know. They give you a list of companies and their impact area and their ticker symbol for your portfolio. That’s it. Do the legwork yourself, or you won’t know the current values behind the words.

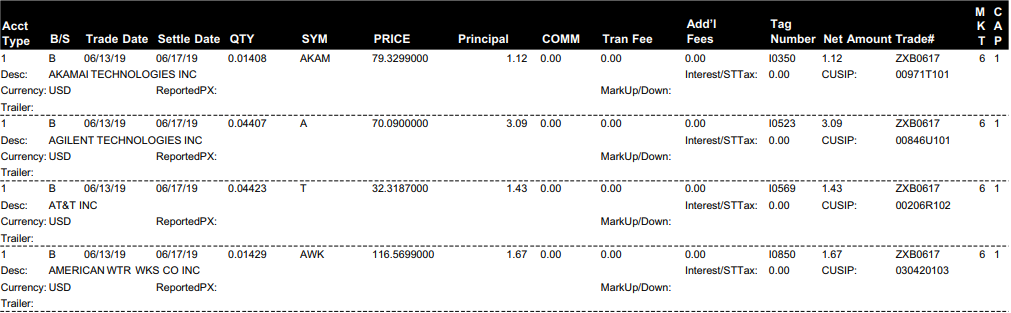

The exception? You can view your documents to see where your money was initially invested. They give you a HUGE summary as a trade confirmation. Considering the sheer number of companies that will be in your portfolio, expect a PDF at least 8 or 9 pages long. The one good thing here is that they give you a LOT of information.

Here’s what some of my confirmations look like:

My $100 was spread super thin. The largest quantity got put into $5.29 for Pepsico Inc. The great thing here though is that no fees are listed. No commission or transaction fees. According to their FAQ, they have a 0.75% annual administration fee, charged monthly.

You also can’t decide who and what you buy, sell, or keep. It’s all or none. Change one Impact Area for another and you’ll lose everything in the first Impact Area and gain a whole new set in the next one.

Literally what you see is what you get. They may have plans to improve in the future, but right now it is highly limited in what you, as an end-user, can see about the companies. You have to take their word that these companies are doing what they can for your Impact Area choices.

Yes, this kind of social investing can help you feel better about doing your part to make the world a better place. And yes, maybe it does make the world a better place. But this is not, and I will repeat this, NOT a good place to invest if you’re looking to play the market and get your money multiplied by selling high and buying low. You could wait 5 years and still see no returns, because the ranking system is not based on how the companies in the portfolio have done in the market. It doesn’t matter if every company in the portfolio is crashing right after you buy in, or has crashed multiple times recently before you buy in. If they are ranked high in an Impact Area you choose, that’s what you get. And you can’t sell the individual stocks, it’s all or none in the Impact Area.

That being said, these are stocks on the market, and the market fluctuates. You may see amazing gains by investing at the right time, or very few losses because the stock are doing okay. You may also see wide variance in your results from other people depending on your Impact Area and when you bought in.

Also, look at that gain/loss of $-99.10. Their calculations definitely are not working correctly, since it is actually $+0.90.

The FAQ questions take you to a new page where the question is answered. To get to the next or a different question, you have to click your browser’s back button and select the question.

Still interested? Okay.

Within each Impact Area you can see examples of companies doing their part for that Impact Area. You can also view COIN’s methodology in selection within that Impact Area. For example, here’s Climate Action:

While the “How do we choose…” does not change, the themes and metrics used to evaluate the company does. Read up on each Impact Area and choose where you want your money.

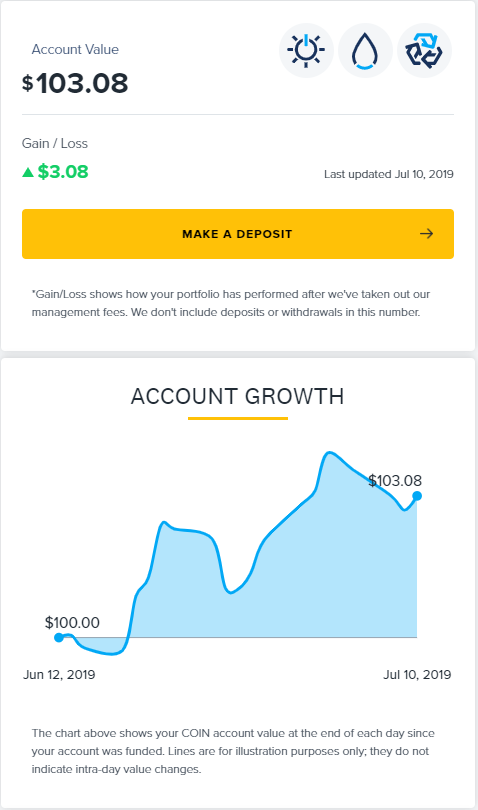

I went into this without much faith or hope in the system, just for the information and for the long-term study. I deposited $100 on June 12 of 2019. In the months to come I will analyze the gains and losses and you can make up your mind where you stand.

As of July 11 of 2019, here’s the gain and chart.