Nvstr is an investment platform where you make your own stock purchases (like Robinhood) but with two key differences. You are charged a commission fee on every trade (so the more of one stock you buy at once, the less you pay in fees), and Nvstr offers pros and cons from the community about each stock and user-defined ideas and portfolio builders. Use the link above to randomly get between $10-1000 to start your portfolio, if you don’t have an account. You have a higher chance of getting lower amounts. Each referral you bring to the site that signs up using your link gives them a chance at the same thing, and gives you an additional chance. You will always get at least $10. To keep this money, you must make at least 1 trade within the first year. After you’ve transferred at least $100, you’ll get an additional $15.

Snapshot

Nvstr

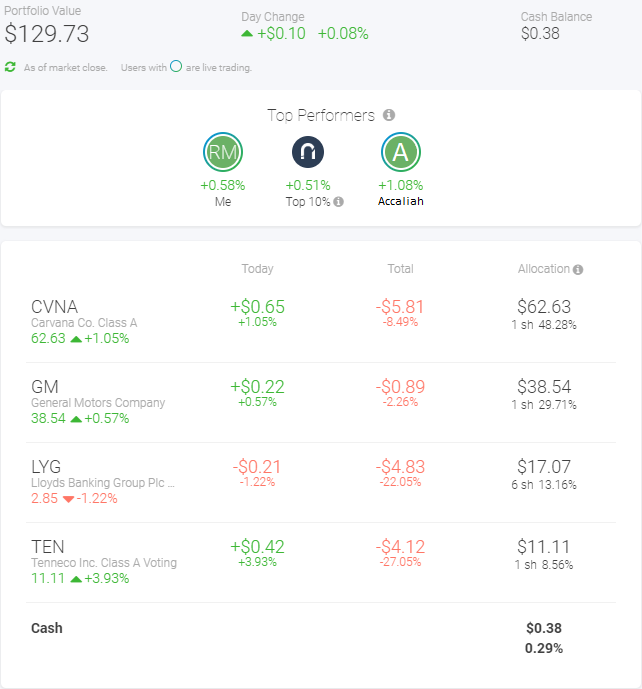

Ouch! That’s a lot of red!

When you’re like me and you’re guessing more than you’re following trends and news or data, or if you listen to bad advice you’re liable to end up looking at the same kind of thing when investing. Instead of investing in a lot of little places like I did on Robinhood, I took a few higher-value stock on Nvstr, and it really shows. Perhaps if I had copied my strategy from Robinhood, I’d be in the green, but at the same time, I still came out with more than I put in! Note that the Top Performers section (shown in the image above) is the daily value of your chosen stock ideas (followed stocks, more on that below), and not your actual portfolio.

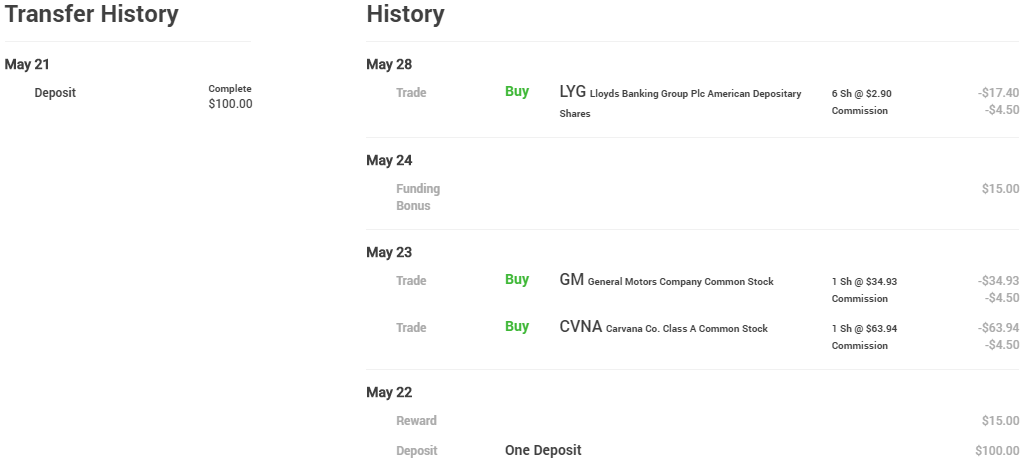

I started with Nvstr on May 22 of 2019, so it has been only a little over a month. I deposited $100.00 after getting a random $15.00 (they offer random value to you when you sign up via referral). Because of my $100.00 transfer, I obtained an additional $15.00. The first $15.00 was because when you sign up you get a random value between $10.00 and $1,000.00 to use to invest (up to $1,000.00). To keep this amount, all you have to do is make a trade (any trade). The second $15 was from a sliding scale of bank transfer amounts. Since I did $100.00, I got $15.00. If you transfer more, you get more. That list is on their site and displayed by amount when you’re making a transfer.

The next day I purchased:

| Stock Symbol | # of Shares | Price per Share | Buy Value |

| CVNA | 1 | $ 63.94 | $ 63.94 |

| GM | 1 | $ 34.93 | $ 34.93 |

Nvstr works on commissions, which means that for every stock you buy, you pay $4.50. That means if you get ten different stocks, you’ll be paying $45.00, but if you get 10 of one stock, you only pay the $4.50 commission. I paid $9.00 in commissions for buying 1 share of two different stocks. This took up the $115.00 I had on hand to pay for stocks, leaving me with $7.13 in buying power. I waited until my second $15 bonus dropped and a few days later bought:

| Stock Symbol | # of Shares | Price per Share | Buy Value |

| LYG | 6 | $2.90 | $17.40 |

Another $4.50 commission. That left me with $0.23 buying power and a whopping $129.77 in total transactions, $13.50 of which were commissions, so I bought a total of $116.27 in stock with $130.00.

As mentioned above, there’s a $4.50 commission on each trade of stock you make (regardless of the number of shares), so if you are like me and buy your shares of stock separately at different times instead of all at once or you don’t have a lot of money to initially invest, you’re going to end up paying for it. I ended up paying $13.50 in commission fees just for those 3 stocks. The thing is, that didn’t hurt me all too much because that was just a little less than one of the $15 bonuses, so to me it didn’t seem like that much of a waste. Of course, I could have been using that to trade, too.

The Nvstr site is set up so you can see your portfolio choices first, build your own followed stocks below that, and see what people are saying about stocks as pros and cons. You can write your own too. This gives not only historical data, but community analysis (though these are not always professional opinions).

The real hit is going to be in the commissions.

Now remember, I only put in $100, so that means I am still $29.73 over what I put in.

Nvstr includes the commission fees in the total (see top image). So even while the stock is up, my total is still in the negative because of the commission.

So, was this a worthwhile experience? Definitely. Robinhood made me a little trade-happy and I should have been paying attention to the commissions. Those really do leave a dent in your earnings.

Additional Investments

I helped Accaliah, my mate, create an account for the benefits of additional money value. Since I would get a random amount and Accaliah would, it would be additional money to use to purchase stock and to buffer against the commission costs.

My bonus ($15.00) arrived on June 20 of 2019, and I used that the next day to buy:

| Stock Symbol | # of Shares | Price per Share | Buy Value |

| TEN | 1 | $ 10.73 | $ 10.73 |

Yes, that did mean another $4.50 in commissions, but because I got $15.00 I was still able to get this stock essentially free.

Now on to Accaliah’s stock choices. I helped her make the decision to purchase primarily dividend stocks. She plans to hold the account for a very long time, so it makes sense to get paid for it. Accaliah’s reward for signup was $12.00 with another $15.00 bonus for a $100.00 deposit, for a total of $127.00 available.

| Stock Symbol | # of Shares | Price per Share | Buy Value |

| VGR | 4 | $ 9.75 | $ 39.00 |

| NRZ | 5 | $ 15.80 | $ 79.00 |

That cost $9.00 in commissions, but it used all of the available money.

As shown above by the Total, neither stock has recovered to where it was when it was purchased. Break-even on price per share means the Total would be -$4.50, with anything higher than that meaning the stock price went up and is now cutting into the commission cost. A $0.00 Total is a gain of $4.50 across all shares of a stock ($1.125 for each of VGR’s shares, for example). Given there is a commission of another $4.50 when you sell, the Total would have to be $4.50 to get back the commission price and break even on the total cost. Anything higher than a Total of $4.50 is a profit.

Dividends

VGR has had a consistent $0.40 dividend every 3 months since June of 2013. That means for 1 share of VGR stock, you would get $1.60 every year ($0.40 per quarter) and does not seem to be based on stock value. VGR has fluctuated between $15.00 and $22.00 until last year (August 2018) when the price plummeted to a little over $9.00. This dividend yield is the equivalent of $4.80 for the 4 shares I have, annually.

NRZ has been giving increasing dividends since June of 2013, starting at $0.07 per share and reaching $0.50 in June of 2017. That means for 1 share of NRZ stock, you would get $2.00 annually ($0.50 per quarter) and may be dependent on stock value, as NRZ has increased the dividends in the past as the price fluctuated but largely increased. This is the equivalent of $10.00 for my 5 shares, annually.

Over time, without much change in stock value or dividend yield, you would obtain:

| Stock Symbol | NRZ x 1 | NRZ x 10 | VGR x 1 | VGR x 10 |

| 1 Year Dividends | $ 2.00 | $ 20.00 | $ 1.60 | $ 16.00 |

| 5 Year Dividends | $ 10.00 | $ 100.00 | $ 8.00 | $ 80.00 |

| 20 Year Dividends | $ 40.00 | $ 400.00 | $ 32.00 | $ 320.00 |

Thoughts

Will I continue to use Nvstr? Yes for the both of us, but only until those stocks I own grow enough that I can pull them out with a definite profit. Accaliah plans to hold these stocks for a significant portion of time and reinvest when the dividend proceeds reach enough to purchase more shares in one of those two stocks. While the platform is nice, I despise commission fees breaking into my profit and Robinhood has none of those fees. Once I pull out my money here, I won’t be looking back. Accaliah’s view I can understand, though there are better ways. All in all, considering dividends and stock value exceeding commission fees, and the bonuses gained covering those costs, I am still happy I invested here for the time being. But I am eager to be able to get away from the commission fees.

Gainers

GM and VGR have both done very well, in excess of $5.00 per share profit. Of course, this means that with this platform I will be making a very slim profit for myself, but NVSTR’s stocks are a purchase to hold long-term for long-term gain. Unless some stocks cover the cost of selling the others, I’m forced to stay in due to the heavy cost of selling shares. If and when the time comes that I can pull everything out for a profit, I will definitely do so, but as only 2 stocks have made a small profit, it’s not enough to cover the entire expenditure.

Mid-September

So far I have sold CVNA and increased my own holdings in VGR.

I sold CVNA at $81.50, a profit of $13.06 even after the commission of $4.50 for selling the stock, since it went up from $63.94. Of course, on a platform like Robinhood that would have been a profit of $17.56 since there are no commission fees there. I also would have saved the $4.50 commission fee for originally purchasing the stock, and so would have spent $63.94 to obtain $17.56 from selling at $81.50. I ending up spending $68.44 to obtain an actual return of $8.56 from selling at $81.50. That measly amount doesn’t even cover the entire commission cost of another buy/sell. There were also Regulatory Fees of $0.02 on this transactions, though I am not sure what from.

Even with all of this, however, I still only put in $200 and have received back $63.12 above and beyond that. Now, that amount could have been $72.00, but I’d say that given a $4.50 commission fee for trading, that’s a pretty good return.

If I see any other stocks moving very far up in value, even though the ones I am holding now are dividend stocks, I may sell them off and hold the cash unless I find a very good stock to put into. Those commission fees can really eat you alive.