An investing app and website that allows you to select stock to buy and sell with no trading fees. Using the link above will allow you to sign up and give you and I a free random stock chosen from Robinhood’s settled shares. If you already have an account, it will not do anything.

Snapshot

Robinhood

My first real investments were on an app called Robinhood, and was entirely my own decisions.

I started using Robinhood in mid-January of 2019, investing $80.00 which resolved on 1/25/2019 after receiving a free stock of FitBit on 1/18/2019 for signing up. But because of the way Robinhood works, they allowed me to use that $80.00 straight out of the gate. I was able to invest the money I had pledged to the app immediately. Not only that, but they have commission-free trading, so I don’t spend a penny on buying or selling shares. All that money is mine.

My first investments were as follows:

| Stock Symbol | # of Shares | Price per Share | Buy Value |

| IDXG | 1 | $ 1.09 | $ 1.09 |

| NTDOY | 1 | $ 38.93 | $ 38.93 |

| CLNE | 1 | $ 1.99 | $ 1.99 |

| GE | 1 | $ 9.24 | $ 9.24 |

| GPRO | 1 | $ 4.90 | $ 4.90 |

| SRAX | 1 | $ 2.78 | $ 2.78 |

| ACB | 1 | $ 6.71 | $ 6.71 |

| SNAP | 2 | $ 5.80 | $ 11.60 |

Why not get 10 shares of IDXG? I didn’t care about quantity, only the safety of diversification. A lot of different low-value shares was a more appealing solution to me than a lot of one share of any value.

Using the remainder of my cash in account, I later bought:

| Stock Symbol | # of Shares | Price per Share | Buy Value |

| CLNE | 1 | $ 1.97 | $ 1.97 |

| VTL | 3 | $ 0.20 | $ 0.60 |

A second investment of $105.00 followed on 2/19/2019, this for the purpose of buying:

| Stock Symbol | # of Shares | Price per Share | Buy Value |

| EA | 1 | $ 103.20 | $ 103.20 |

| IDXG | 2 | $ 0.9534 | $ 1.9068 |

| VTL | 2 | $ 0.219 | $ 0.438 |

VTL (Vital Therapies) merged with Immunic (now IMUX) at a conversion of 1 IMUX share for every 40 VTL shares, rounded up. Since I had 5 shares valued at a total of $1.038, I received 1 share of IMUX, which was at the time about $24. I should have seen that and sold immediately upon the stock conversion. Because I didn’t, instead of seeing a $22.96 profit from those shares, it now sits at $9.52, only a profit of $8.48. Of course that is still a very good profit from the conversion, but I really should not have waited. The valuation of the company post-merger was significantly higher than the market value, as a day later it was $16.30, then fluctuated down to a low of $10.85 a month later. $9.00 was it’s lowest on June 12 of 2019.

That was perhaps my biggest mistake so far. Of course, it could have gone the other way, but I felt it was unlikely even though I did not act on the merger.

On April 25 of 2019, I received $0.01 as a dividend from my GE share.

How did I feel about all this? I was pretty chill. Sure, I checked the app almost every day to see it’s value. I still do. But it was important to me to let the shares gain and lose on their own without worrying too much about the value. It was just important to see that the value was changing.

On June 7 of 2019 I finally made some decisions to sell.

| Stock Symbol | # of Shares | Buy Price per Share | Sell Price per Share | Sell Value | Profit |

| SNAP | 2 | $ 5.80 | $ 14.00 | $ 28.00 | $ 16.40 |

As of June 18 of 2019 the highest price has been $14.86, so I sold a little early.

I used this money to buy:

| Stock Symbol | # of Shares | Price per Share | Buy Value |

| F | 2 | $ 9.75 | $ 19.50 |

| ACB | 1 | $ 7.69 | $ 7.69 |

| IDXG | 1 | $ 0.70 | $ 0.70 |

Since then, I have selected several limit sell prices for some of my shares. That is, if they reach a certain amount during market hours, it will sell the share(s) automatically at that price. I have set the limit sells at profits of upwards of $5.00 per share or higher, depending on how certain stocks are doing or expected to do.

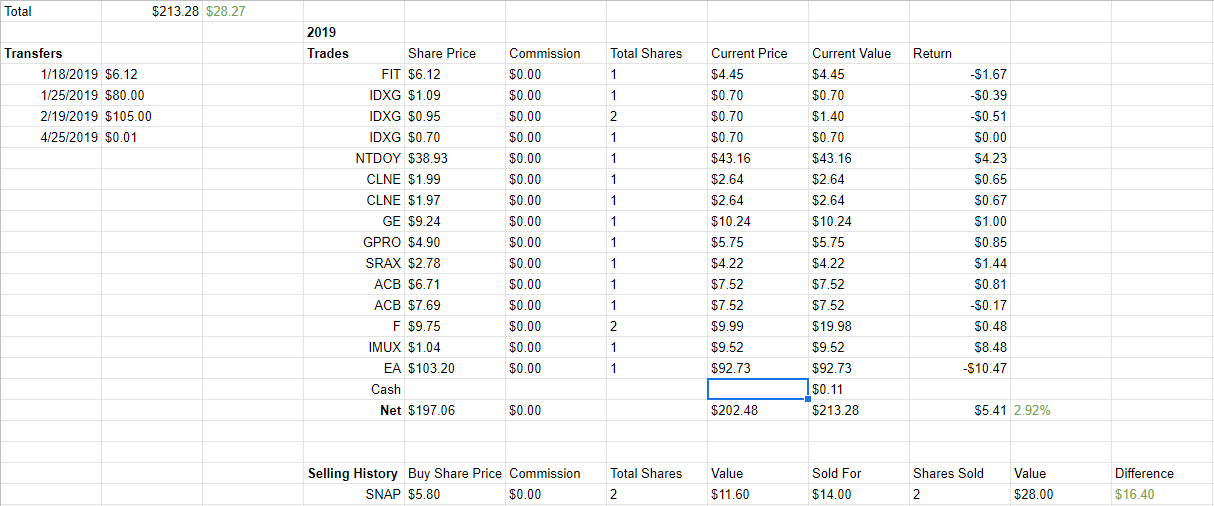

Considering I put in $185.00 and received a free share of FIT (currently $4.45), my account value is $213.28 as of writing this.

That will, of course, fluctuate, but I have been very happy with my results for my first investment venture, especially considering I did so with no guidance and only from historical stock data on the app.

Could it have been better or worse? Of course! But confidence in my own ability to wait out downturns in the market to see a rise in price allowed me to make the final call to make the trades.

I will definitely continue to use Robinhood, and the money that I make from selling shares higher than I got them will allow me to branch out to other stocks, which will then gain or lose as they do, and when they do gain, I’ll sell those at a certain point and continue the process.

As it has only been 5 months, there is not a lot to go on, but my initial experience has been nothing but positive. I have kept track of my prices via Google sheets and am happy with the results, even those stock that have fallen over 5% from initial purchase. I have time. I can wait.

Voting Shares

One of the interesting things I have noticed about Robinhood is that they make sure that you, as a stock-holder have the information relating to stock mergers or changes, and voting shares you hold have them send you an email detailing the occurrence and who you need to know and do to be a part of it. For example, holding a share of GoPro stock will allow you to vote in their meetings where votes are held, for election of Directors and proposals presented to the company. You do so by following the link in the email and selecting your preferences, then submitting. They will email you a confirmation of your vote. I’m not sure how other sites with similar stock options handles their voting shares, but I like the way that Robinhood has done it.

Support

Their support is very effective. They seem to have 24/5 support, available Monday to Friday at any time of the day. I like the way they handle themselves, and when requested a support staff member will turn over the support question thread to another member. Very happy with their support.

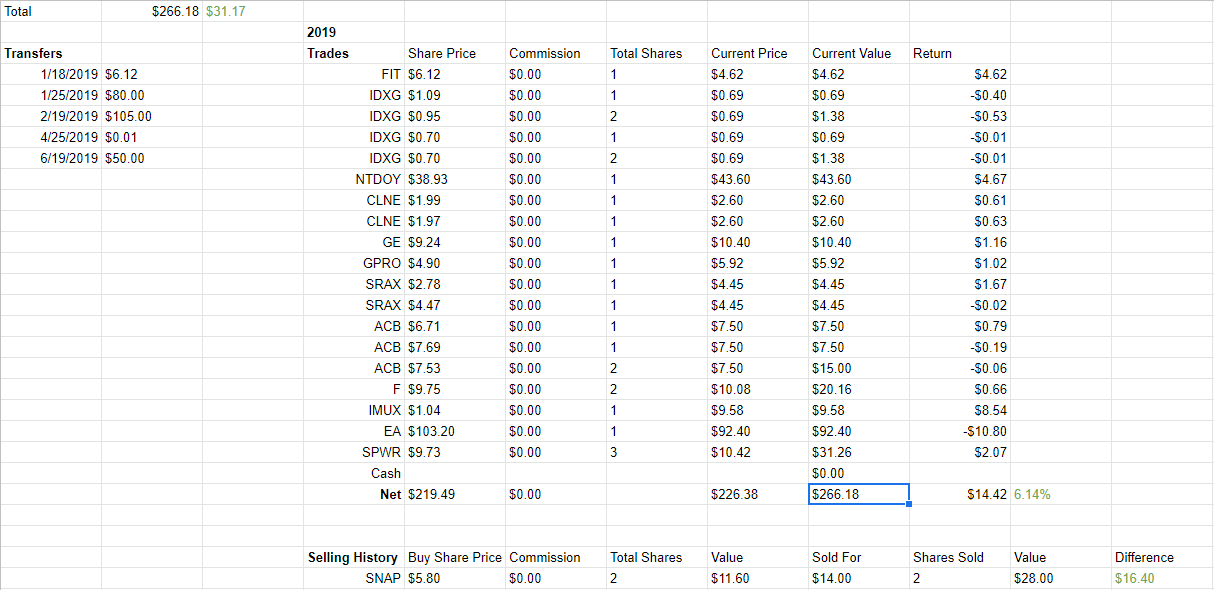

Additional Investments

I added an additional $50 on June 19 of 2019 before the market opened and set limit buys (the stocks would be purchased at the set price I specified if the Price per Share was equal or better). I end up with:

| Stock Symbol | # of Shares | Price per Share | Buy Total |

| ACB | 2 | $ 7.53 | $ 15.06 |

| SPWR | 3 | $ 9.73 | $ 29.19 |

| IDXG | 2 | $ 0.6967 | $ 1.39 |

| SRAX | 1 | $ 4.47 | $ 4.47 |

After this I had no cash balance. While that means there isn’t money sitting there not potentially gaining, it also means I can’t buy anything unless I make another deposit. Some people invest with the idea to leave some of their value as cash for buys, while I am of the mindset that cash will not earn you anything above and beyond its current value, but that also means my entire value can dip. But given the returns I have seen so far, I don’t expect to be changing that viewpoint any time soon.

I received a free stock of SIRI for inviting Accaliah to invest with her own account.

On June 24 of 2019 I had a limit sell activate on IMUX.

| Stock Symbol | # of Shares | Buy Price per Share | Sell Price per Share | Sell Value | Profit |

| IMUX | 1 | $ 1.04 | $ 11.04 | $ 11.04 | $ 10.00 |

The price fluctuated throughout the day to upwards if $19.28 at 4:16PM, which is an additional $8.24 above what I sold for. Should I have waited? Maybe. I like to believe that in receiving the $10 I insulated myself in case it fell below again. But, at the same time, had I not had a limit sell in place I might not have sold it until I saw more of a profit. In all, had I sold at around $18.04, I would have made a profit of $18 instead of $10. Not a lot of money, but when I start trading in greater quantities it will be more important to watch price fluctuations. If I had a number of shares in the company, say 10, that could have easily been a $80 difference. Still small? 100 shares would have a difference of $800. It will be important for me to review and decide larger quantity sells in the future, as I certainly don’t want this to happen again. Lesson learned!

I have cancelled all of my limit sells and will be reviewing my portfolio daily for price changes and value increases.

With the money I made from IMUX, I purchased:

| Stock Symbol | # of Shares | Price per Share | Buy Total |

| FIT | 2 | $ 4.45 | $ 8.90 |

I am now holding $2.12 in cash. I don’t think I’ll place that anywhere, such as IDXG like I usually do. I’ll hang on to it for now and see where the market goes from here.

(And I just noticed my sheet has the second FIT left-aligned, so I’m going to go fix that.)

On June 25 of 2019, I sold:

| Stock Symbol | # of Shares | Buy Price per Share | Sell Price per Share | Sell Value | Profit |

| NTDOY | 1 | $ 38.93 | $ 44.20 | $ 44.20 | $ 5.27 |

This was so that I could try and jump on the bandwagon and buy:

| Stock Symbol | # of Shares | Price per Share | Buy Total |

| IMUX | 3 | $ 13.48 | $ 40.43 |

| XXII | 1 | $ 1.97 | $ 1.97 |

“What bandwagon?” you may ask. IMUX was skyrocketing on 6/24, from an early $9.30 to a little under $18.00. Remember I said that I had a limit sell activate? Well that was on the same day. It hit the limit sell a little into mid-day, and the day ended strong.

But I missed the bandwagon. On 6/25 the stock started to decrease, down to a low of $12.00 now (6/28 a little after 2:30PM). Since I got my shares at $13.48 each, I’m only down $4.43, and it will likely go back up in the future to above the cost I paid to get them, which is when I can sell them myself.

I am sad I missed the bandwagon, as the price practically doubled, but I didn’t have a lot to put into it to begin with. That started my idea for a loan, though, so that I’d have a more significant amount of capital to put in to different other stocks that might see at least 20% growth within 3 months.

Head over there to view all the Robinhood trades made with the loan money.

Leave a comment